I could post 30 charts on secondary ideas like DBA, ABX, etc. But I am going to keep it simple and just show you 3 major commodity ETFs to summarize the strong recent commodity action. I think we are a 2-4 weeks into a major move in the commodities. Laid out my thesis a few weeks ago. These should be multi month runs after their bottoms a month ago.

REMX (Favorite Recent Idea)

This weekly chart was as pretty as it gets. It was perfect. We are now 4 weeks into a move. 8 week rule in effect.

Given the strength of the move and the fact this was a high quality base on base (a second 1-2), this has huge potential in this third wave. I will not sell this until I see an obvious sell signal. And I will be holding pieces of my position until they violate the 20, 50, and 200 days. We are nowhere close to any of these on REMX only 4 weeks into its move. That's how I handle my positions with big stock potential. Fundamentally, I think REMX was the strongest pick too because it had more "new" in it. Has exposure to electric car, wind turbines, alternative energy, etc.

URA

Another powerful base on base. Already had pocket pivots thru 50 and 200 days. Forming a nice handle just above and still riding the 10 day. Look how it rode the 20 day in its last power move.

GDX

The granddaddy of em all. And the most hated. Up through the 50 and 200 this week. Shook off bad news in ABX. The above 2 ETFs are unknown or "off the run". The GDX is known but hated. That's what makes big stocks if you are right - off the run or hated sentiment. And a big catalyst/theme - like a new president with protectionist policies and a bottom in long term interest rates. GDX about to take out its trend line.

Keep it simple. Find your best ideas, focus on them, buy and sell them properly. If you get stopped out, you get stopped out.

Sunday, July 30, 2017

Monday, July 3, 2017

Midyear 2017 update

We are at an interesting cross roads for the market. Leaders like AMZN that have been on +8 year runs have had hit big round numbers. Put/Calls have been low. The underperformance of commodity stocks have had a parabolic move which I retweeted recently. The QQQs have started to weaken. While interest rates have probably put in an all time low.

My best guess is the next bull market will be glad by commodities and inflationary trades. Usually you need the market to get hammered and the next leaders to show relative strength. first

So here is a recap of some long term ideas have been tracking so you can pounce.

REMX (rare earths) - Look at all of those tight weekly closes!!!!!!! If this base works, the upside of this is a enormous. The second base would be interpreted as a second 1-2. Has had pivot points recently for possible entries. Not sure if this base needs one more shakeout. I have half a position. A big one. But not mach 2 with my hair on fire big.

URA - nice candle on the monthly. Hasn't made a lower low. Just had a pivot point through 50 day. Might need one more low. Same position size as REMX.

CCJ is a leader in URA. Looks like it needs a final shakeout in its first base it has had in years. I have a tiny position.

XLE - up through 50 day. probably needs one more shakeout despite recent strength. The monthly shown here had same setup as IWM last year. Nice doji to end the month. Small position.

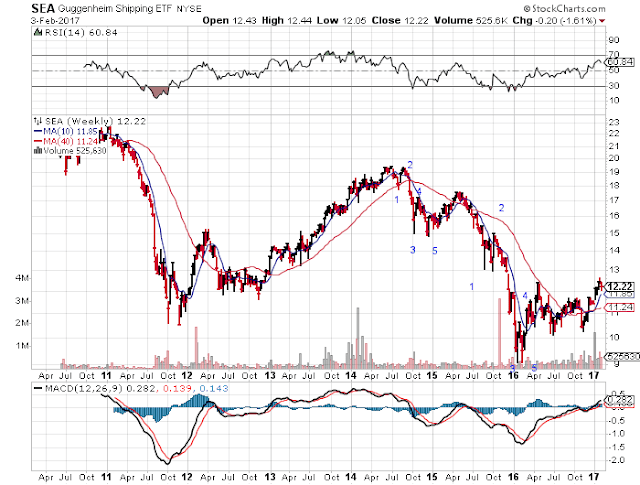

SEA - might need one more low but just ripped the faces off of the shorts. pivots already through 50 and 200 day.

GDX and ABX. Original pivot points have hit some stops. Still like the long term ideas. the monthlies look like they need a final shakeout. But look at all those tight closes on GDX. If they rinse these in next 2-3 weeks, they look like buys on shakeout plus 8% setups. I'm confident those 2015 lows are the lows for a long long time.

CS just had pivot points too. Beautiful cup in a larger cup and handle. Wow!!!! Still have a medium sized position which i was never stopped out on.

My best guess is the next bull market will be glad by commodities and inflationary trades. Usually you need the market to get hammered and the next leaders to show relative strength. first

So here is a recap of some long term ideas have been tracking so you can pounce.

REMX (rare earths) - Look at all of those tight weekly closes!!!!!!! If this base works, the upside of this is a enormous. The second base would be interpreted as a second 1-2. Has had pivot points recently for possible entries. Not sure if this base needs one more shakeout. I have half a position. A big one. But not mach 2 with my hair on fire big.

URA - nice candle on the monthly. Hasn't made a lower low. Just had a pivot point through 50 day. Might need one more low. Same position size as REMX.

CCJ is a leader in URA. Looks like it needs a final shakeout in its first base it has had in years. I have a tiny position.

XLE - up through 50 day. probably needs one more shakeout despite recent strength. The monthly shown here had same setup as IWM last year. Nice doji to end the month. Small position.

SEA - might need one more low but just ripped the faces off of the shorts. pivots already through 50 and 200 day.

GDX and ABX. Original pivot points have hit some stops. Still like the long term ideas. the monthlies look like they need a final shakeout. But look at all those tight closes on GDX. If they rinse these in next 2-3 weeks, they look like buys on shakeout plus 8% setups. I'm confident those 2015 lows are the lows for a long long time.

CS just had pivot points too. Beautiful cup in a larger cup and handle. Wow!!!! Still have a medium sized position which i was never stopped out on.

Monday, May 15, 2017

May 17 Update

Here are the 3 charts that have most interested me in the past few weeks:

ABX - looks like a clear 5-3-5 down that has completed. Look at that doji or morningstar at the bottom!

REMX - Look all those tight weekly closes, that is as pretty as it gets.

URA - looks like it put in a double 3 down. With the final 3, a 3-3-5 down.

All of these are just below the 200 day. If you got stopped out previously, or you are looking at these for the first time, up through the 200 day is a proper entry.

ABX - looks like a clear 5-3-5 down that has completed. Look at that doji or morningstar at the bottom!

REMX - Look all those tight weekly closes, that is as pretty as it gets.

URA - looks like it put in a double 3 down. With the final 3, a 3-3-5 down.

All of these are just below the 200 day. If you got stopped out previously, or you are looking at these for the first time, up through the 200 day is a proper entry.

Sunday, April 23, 2017

Update 4/23

I am going to keep this really simple.

I like to focus only my very best ideas.

REMX is the first base I've seen since GDX/ABX where the bottom of the current base might have put in.

Look at that weekly bar! High volume, tight close, close in the higher end of the range. Many tight closes in the base. Beautiful rinse of an upward sloping 200 day. I started to make it a real position on this rinse. I previously bought this small at the right time in the last base. If this goes lower one more time I'm going to be there. If I like the way it takes out the 200 day and 50 day on the upside, I'll add there too. I love the looks of this.

I liked the look of RBS overseas, so I bought more of that before it started to rip this week. I like owning good Europe names going into a known event everyone is worried about.

I have waiting for URA down by the 200 day. At there I will make this a real position. Have a smaller position so far.

I still own my max position size in the gold miner complex thru GDX/ABX. I have not been stopped out and am profitable on the positions so far. I haven't had a real sell signal. Keeping it simple. No reason to sell.

I like to focus only my very best ideas.

REMX is the first base I've seen since GDX/ABX where the bottom of the current base might have put in.

Look at that weekly bar! High volume, tight close, close in the higher end of the range. Many tight closes in the base. Beautiful rinse of an upward sloping 200 day. I started to make it a real position on this rinse. I previously bought this small at the right time in the last base. If this goes lower one more time I'm going to be there. If I like the way it takes out the 200 day and 50 day on the upside, I'll add there too. I love the looks of this.

I liked the look of RBS overseas, so I bought more of that before it started to rip this week. I like owning good Europe names going into a known event everyone is worried about.

I have waiting for URA down by the 200 day. At there I will make this a real position. Have a smaller position so far.

I still own my max position size in the gold miner complex thru GDX/ABX. I have not been stopped out and am profitable on the positions so far. I haven't had a real sell signal. Keeping it simple. No reason to sell.

Saturday, March 25, 2017

Update - March 2017

I don't overpost to get clicks or traffic. I only post when I have big ideas currently or when I am "stalking" them.

Last year my big idea was the IWM. I posted then. And then I've been posting in late Dec, Jan and Feb when I've been exiting. I exiting my final piece of that and the SPYs in the last 2 weeks. I didn't like the exhaustion gap on the SPY after the POTUS state of the union. I didn't like the sentiment levels. The SPYs I sold 3 days after the speech.

Meanwhile the IWM put in a short term double top. The remaining IWM I sold on the double top break and break of 50 days. I've been 100% out since those sells.

So I now have one full sized position. The gold miners thru - GDX and ABX. 35% position combined. 3% risk to equity. ABX is one of the more beautiful longer term bottoms I've seen with now a solid cup and handle first stage base that is thru its 50 and 200 days with pocket pivots

And I'm staking 2 other big ideas.

Uranium - Thru URA and CCJ. I have a 13% position basically off earlier break of 200 and 50 days. I'm waiting for completion of second base to build and then go to make bigger. URA could be done going down or this C will keep going. I added a little late last week. I would love! this at 200 day. The first base it broke out from in December is as beautiful as it gets. I don't think 7 weeks is it for a move which should be a year in duration.

And SEA. have 13% position on breakout of a weak handle. Waiting for longer, more real handle to complete to make bigger. A lot of tight closes

I have a smaller position in REMX ,similar position I haven't been stopped out on, that's it. Hope that helps. Those are big ideas currently and my biggest updates. Keeping it simple.

Last year my big idea was the IWM. I posted then. And then I've been posting in late Dec, Jan and Feb when I've been exiting. I exiting my final piece of that and the SPYs in the last 2 weeks. I didn't like the exhaustion gap on the SPY after the POTUS state of the union. I didn't like the sentiment levels. The SPYs I sold 3 days after the speech.

Meanwhile the IWM put in a short term double top. The remaining IWM I sold on the double top break and break of 50 days. I've been 100% out since those sells.

So I now have one full sized position. The gold miners thru - GDX and ABX. 35% position combined. 3% risk to equity. ABX is one of the more beautiful longer term bottoms I've seen with now a solid cup and handle first stage base that is thru its 50 and 200 days with pocket pivots

And I'm staking 2 other big ideas.

Uranium - Thru URA and CCJ. I have a 13% position basically off earlier break of 200 and 50 days. I'm waiting for completion of second base to build and then go to make bigger. URA could be done going down or this C will keep going. I added a little late last week. I would love! this at 200 day. The first base it broke out from in December is as beautiful as it gets. I don't think 7 weeks is it for a move which should be a year in duration.

And SEA. have 13% position on breakout of a weak handle. Waiting for longer, more real handle to complete to make bigger. A lot of tight closes

I have a smaller position in REMX ,similar position I haven't been stopped out on, that's it. Hope that helps. Those are big ideas currently and my biggest updates. Keeping it simple.

Sunday, February 12, 2017

Update - 2/11/17

Here are updates on my recent trade ideas

CCJ - Came into 200 day and had nice bounce! I added down around the 200 day. Like how name shrugged off mediocre EPS. It regained 50 day. I'd like to see the action tighten up now and generally start to ride that 50 day up.

SEA - Could be forming first proper handle and had a "continuation" pocket pivot on Friday. I added on the day it came into 50 day. Handle might need more work.

ABX/GDX - GDX took out 200 day this week. A good sign. ABX, shown here, is the strongest name in the group. If they form handles properly, I will add. Have nice sized core positions from weeks past. Most of the places where I see strength are inflationary! I am noticing a theme.

VIAV - Short term blow off top? Sold half.

CS - working on that last shakeout. No adds yet.

TBT - I would LOVE this down by the 200 day.

Z - never broke out. broken for now. That's why I had small cheater position on and nothing too aggressive. I sold the day of EPS when it gapped below 50 and 200 days. Wait for proper entry if it sets up again.

CCJ - Came into 200 day and had nice bounce! I added down around the 200 day. Like how name shrugged off mediocre EPS. It regained 50 day. I'd like to see the action tighten up now and generally start to ride that 50 day up.

SEA - Could be forming first proper handle and had a "continuation" pocket pivot on Friday. I added on the day it came into 50 day. Handle might need more work.

ABX/GDX - GDX took out 200 day this week. A good sign. ABX, shown here, is the strongest name in the group. If they form handles properly, I will add. Have nice sized core positions from weeks past. Most of the places where I see strength are inflationary! I am noticing a theme.

VIAV - Short term blow off top? Sold half.

CS - working on that last shakeout. No adds yet.

TBT - I would LOVE this down by the 200 day.

Z - never broke out. broken for now. That's why I had small cheater position on and nothing too aggressive. I sold the day of EPS when it gapped below 50 and 200 days. Wait for proper entry if it sets up again.

Sunday, February 5, 2017

Update - 2/5/17

The indices are still in no man's land in the short term. Long term they still look solid. I sold another 1/4 of my SPY exposure from 2016...basically to finance single stock positions, some highlighted below.

I'm going to give you quick observations on my potential top ideas.

CS - Still waiting for final flush in second part of a leading diagonal. So far it looks perfect to me. Before this diagonal CS had 3 corrections down. There are never 4. That's why it has top idea potential if it sets up again. Love at 13 on a bad earnings reaction or europe headline.

GDX - has already taken out trendline of a double 3 correction. Took out 50 day. About to take out 200 day that will be another confirm of another new uptrend. I own this and component leader ABX.

SEA - Coming into 50 day. Already has 50/200 day cross. After a second 5-3-5 down much like IWM in 2015/early 2016. Had a 9 month correction, now trying to uptrend.

CCJ - Uranium stocks had big run last 2 months and now consolidating big run. CCJ is the leader. About to complete a first ABC down. At 50 day. 200 day not far away. Those are good spot trade spots. Have a starter position in CCJ the last 2 days and early took a starter position in rare earths REMX. Looking at ETF URA.

I'm going to give you quick observations on my potential top ideas.

CS - Still waiting for final flush in second part of a leading diagonal. So far it looks perfect to me. Before this diagonal CS had 3 corrections down. There are never 4. That's why it has top idea potential if it sets up again. Love at 13 on a bad earnings reaction or europe headline.

GDX - has already taken out trendline of a double 3 correction. Took out 50 day. About to take out 200 day that will be another confirm of another new uptrend. I own this and component leader ABX.

SEA - Coming into 50 day. Already has 50/200 day cross. After a second 5-3-5 down much like IWM in 2015/early 2016. Had a 9 month correction, now trying to uptrend.

CCJ - Uranium stocks had big run last 2 months and now consolidating big run. CCJ is the leader. About to complete a first ABC down. At 50 day. 200 day not far away. Those are good spot trade spots. Have a starter position in CCJ the last 2 days and early took a starter position in rare earths REMX. Looking at ETF URA.

Sunday, January 29, 2017

Update - 1/29/17

I have started several new commodity related positions the last 1-2 weeks. New positions are 5-10% positions, nothing crazy, have 8% stops on these. My exposure has ramped modestly. I'm not full on aggressive but have some exposure on. Here is the quick recap of my positions.

IWM - still have 1/4 of my position on (from 2016). held the 50 day nicely. still not out of the woods.

SPY - had a smaller position last year vs IWM, still have 1/2 my position on. With regard to the market, in short term I am concerned about the bullish Barron's cover this weekend and the lack of a true flush - low volatility. But long term trend still intact for both IWM and SPY, need to keep some on.

VIAV - wave 3 can't be the shortest. with breakout from flat base this week, this is going on a long run. love the 50/200 days up.

CS - still hasn't had the flush I'm looking for yet for a second major setup. still have my 10% position on from set/oct/nov.

Z - Still trading tight in the handle. This one could go either way. 5% position.

REMX - rare earths! broke out from a cup and handle, 200 day flatting/curling up, 50 day up. after a long, long downtrend. 5% position.

SEA - similar to REMX.

GDX - had a second long bear market undercutting lows from a decade ago similar to our equity indices in 08/09. Looks like it started an uptrend and then completed its first correction. Just had a pocket pivot thru 50 day.

IWM - still have 1/4 of my position on (from 2016). held the 50 day nicely. still not out of the woods.

SPY - had a smaller position last year vs IWM, still have 1/2 my position on. With regard to the market, in short term I am concerned about the bullish Barron's cover this weekend and the lack of a true flush - low volatility. But long term trend still intact for both IWM and SPY, need to keep some on.

VIAV - wave 3 can't be the shortest. with breakout from flat base this week, this is going on a long run. love the 50/200 days up.

CS - still hasn't had the flush I'm looking for yet for a second major setup. still have my 10% position on from set/oct/nov.

Z - Still trading tight in the handle. This one could go either way. 5% position.

REMX - rare earths! broke out from a cup and handle, 200 day flatting/curling up, 50 day up. after a long, long downtrend. 5% position.

SEA - similar to REMX.

GDX - had a second long bear market undercutting lows from a decade ago similar to our equity indices in 08/09. Looks like it started an uptrend and then completed its first correction. Just had a pocket pivot thru 50 day.

Saturday, January 14, 2017

Review - 1/14/17

Continued to cut my shorter term exposures this week. I was fully long most of 2016, started to proactively cut in mid to late december on some potential offensive sell signals, now I've started to cut some more on a few short term defensive sell signals. Here are other things I've seen.

(1) my biggest 2016 bet the IWM continues to live below the 20 day with no big flush yet

I still have piece of IWM on. 1/4 of my original bet going into election. To get short term bullish and longer again, I want to see it test/flush the 50 day. That's a juicy spot to get long and assume more risk. So far it has been consolidating nicely. I do love how the 50 day is curling up.

(2) we have had bullish Barrons covers and people crowing about how Soros is getting carried out

(3) we have a big bull - bear spread again

(4) range compression is flashing a short term bearish signal

There are some individual stock ideas I potentially love for 2017 but they might need some work in the short term.

CS

I love the 3 long term waves down in CS. As Billy O says, you rarely have 4!!!! Elliott Wave says that too.

I also love the 50/200 day cross.

The first proper entry was taking out the 50 to 200 days last year. I would wait for a flush or retest of 50 or 200 day for next entry if you are not in it. I'd love to see it flush that late December low, get close to that 200 day. Then I might assume maximum risk like I did with IWM last year, it might look like that kind of trade for me. At that point, you want your stop to be 2-3x ATR. Or you could assume 8-10% stop loss off that 200 day. I have half a position on from October/November - high 13s cost.

Z

Z has some nice tight closes in a handle of a cup and handle. Next official pivot point is top of handle. riding the 50 day up. There are some prior pocket pivots and entries lower that haven't stopped people out. Zillow not reporting until 2/7. No position yet.

(1) my biggest 2016 bet the IWM continues to live below the 20 day with no big flush yet

I still have piece of IWM on. 1/4 of my original bet going into election. To get short term bullish and longer again, I want to see it test/flush the 50 day. That's a juicy spot to get long and assume more risk. So far it has been consolidating nicely. I do love how the 50 day is curling up.

(2) we have had bullish Barrons covers and people crowing about how Soros is getting carried out

(3) we have a big bull - bear spread again

(4) range compression is flashing a short term bearish signal

There are some individual stock ideas I potentially love for 2017 but they might need some work in the short term.

CS

I love the 3 long term waves down in CS. As Billy O says, you rarely have 4!!!! Elliott Wave says that too.

I also love the 50/200 day cross.

The first proper entry was taking out the 50 to 200 days last year. I would wait for a flush or retest of 50 or 200 day for next entry if you are not in it. I'd love to see it flush that late December low, get close to that 200 day. Then I might assume maximum risk like I did with IWM last year, it might look like that kind of trade for me. At that point, you want your stop to be 2-3x ATR. Or you could assume 8-10% stop loss off that 200 day. I have half a position on from October/November - high 13s cost.

Z

Z has some nice tight closes in a handle of a cup and handle. Next official pivot point is top of handle. riding the 50 day up. There are some prior pocket pivots and entries lower that haven't stopped people out. Zillow not reporting until 2/7. No position yet.

Monday, January 2, 2017

Year in Review 2016

2016 was a great year professionally for me. Started a new job and had some success. It was a job that gave me fulfillment. I helped people and also used some of my skills that make me happy.

Also, I made progress in my trading. My trading report card said I was up 37% this year. If I was giving myself a letter grade, it was around a B+. You'll see below.

Here were my lessons from winners for the year:

Only focus on the best setups that you understand.

My biggest winner was my IWM trade outlined in this blog earlier this year. I had seen that setup before in 1998. Pattern recognition! Your biggest trades make or break your year. This was the one for me, similar to my AMZN trade in 09. A very clear zig-zag (5-3-5) that had exhausted itself.

I focused really really well this year.

Panic and poor sentiment matters when you have charts you understand. Don't be afraid to use these moments to start a position or pyramid.

Don't be afraid to pyramid when you feel like you have a great 12 month trade and use sentiment and pattern recognition to help. 80% of my capital I traded this year went into trades when that IWM zig zag was completing in January and February. That was a great pattern and sentiment was awful. But I put in 10% after Brexit completed. And another 10% the Friday before the Presidential election. I only traded 3 times this year. The last 2 entries or pyramids were perfectly completed short term corrections in structure into the 200 day. With major derisking events in the news!

Less is more!

Because I had a new job this year, I barely had an hour a week to devote to my trading - basically 2 cups of coffee on the weekend and 5-10 min of train reading if I had the 5-10 min during the week. I only focused on my best trades this year (IWM, VIAV, LITE and a CS entry in Nov). This was my second best personal trading year in the last decade! I spent the least amount of time! I only checked my 3-5 quotes once in the middle of the market hours. I did any market work before or after my normal work day and the market day. That's really important. If it's good enough for Billy O, it's certainly good enough for me! Checking quotes frequently makes me and other longer term swing traders too emotional. You need to check in once to see if you've been stopped out or a trade has triggered for the day and be done with it. If you are a skilled day trader, this doesn't apply. But for the rest of us, less quote checking is more.

Here was my biggest lesson from mistakes this year:

When in doubt, trust the 200 day in an up trending security.

This was my biggest selling mistake of the year. Similar to PCLN 2009. Had a great cost. Great fundamental case. Never broke an up trending 200 day. Should have had a position and SAT until I was stopped out.

My market thoughts from here:

We are in a trickier spot.

Sentiment is higher. Bulls are higher around 50-60%. People suspect Trump will be good for business and the markets after being totally caught flat footed in November.

There are 2 real scenarios. The bulls scenario is markets went sideways for 2 years. In the big picture, the markets also went sideways for 16 years since the 2000 high. We might consolidate more for a few weeks but market is going much higher. 60% chance.

The bear scenario is the post Trump election stock market reaction was a blowoff and a real bear market is coming. 40% chance.

I don't the answer. The post Trump market run looks a little short compared to the 10 months of stock market action that preceded it. 99/00 had a nice 4 month blowoff, not 4 weeks.

More on the bulls case - The S&P (less frothy) and IWM (the leader to date) looks like they have finished 2 1-2s (that is how I drew the IWM chart above, S&P looks even cleaner) and what we have now is maybe our first 3rd wave in the major indices. The meat of the move you don't want to miss! Again, we had many derisking events in 2016 including the pre election in early November. I am using 1997/1998 and 1999/2000 as my market guides. If we break down from these examples, I will be out of everything. But we have not broken down yet. Here is what the IWM looked like in late 90s for your reference.

My short term answer for my own trading is I have cut my exposures some for first time in a year. I was 50-75% levered much of last year. I think in mid Dec (anticipatory, IWM was out of bollinger bands) or now (reactive, we've had a few IWM closes below the 20 day) are reasonable times to cut exposures, generally get off leverage, take some profits. I am still keeping a core unlevered market bet with trailing stops - set at 50 and 200 days. If market rips I'm there. If it breaks down, trailing stops will take me out. If we get a better short term set up, I have capital to deploy.

Examples of what I've done lately is selling half of my VIAV after completing a possible 5 after a possible O'Neil climax run (up 6 out of 7 days). But I am keeping half and listening to my own advice above. 200 day and 50 day are up trending. I should be using 200 day as a stop for a long term core position. My original thesis was Jan 2016 ended a 6 year downtrend in the stock.

Good luck to everyone in 2017 and Happy New Year! Hope the above helps. Please learn from my 2016 mistakes and improvements.

Also, I made progress in my trading. My trading report card said I was up 37% this year. If I was giving myself a letter grade, it was around a B+. You'll see below.

Here were my lessons from winners for the year:

Only focus on the best setups that you understand.

My biggest winner was my IWM trade outlined in this blog earlier this year. I had seen that setup before in 1998. Pattern recognition! Your biggest trades make or break your year. This was the one for me, similar to my AMZN trade in 09. A very clear zig-zag (5-3-5) that had exhausted itself.

I focused really really well this year.

Panic and poor sentiment matters when you have charts you understand. Don't be afraid to use these moments to start a position or pyramid.

Don't be afraid to pyramid when you feel like you have a great 12 month trade and use sentiment and pattern recognition to help. 80% of my capital I traded this year went into trades when that IWM zig zag was completing in January and February. That was a great pattern and sentiment was awful. But I put in 10% after Brexit completed. And another 10% the Friday before the Presidential election. I only traded 3 times this year. The last 2 entries or pyramids were perfectly completed short term corrections in structure into the 200 day. With major derisking events in the news!

Less is more!

Because I had a new job this year, I barely had an hour a week to devote to my trading - basically 2 cups of coffee on the weekend and 5-10 min of train reading if I had the 5-10 min during the week. I only focused on my best trades this year (IWM, VIAV, LITE and a CS entry in Nov). This was my second best personal trading year in the last decade! I spent the least amount of time! I only checked my 3-5 quotes once in the middle of the market hours. I did any market work before or after my normal work day and the market day. That's really important. If it's good enough for Billy O, it's certainly good enough for me! Checking quotes frequently makes me and other longer term swing traders too emotional. You need to check in once to see if you've been stopped out or a trade has triggered for the day and be done with it. If you are a skilled day trader, this doesn't apply. But for the rest of us, less quote checking is more.

Here was my biggest lesson from mistakes this year:

When in doubt, trust the 200 day in an up trending security.

This was my biggest selling mistake of the year. Similar to PCLN 2009. Had a great cost. Great fundamental case. Never broke an up trending 200 day. Should have had a position and SAT until I was stopped out.

My market thoughts from here:

We are in a trickier spot.

Sentiment is higher. Bulls are higher around 50-60%. People suspect Trump will be good for business and the markets after being totally caught flat footed in November.

There are 2 real scenarios. The bulls scenario is markets went sideways for 2 years. In the big picture, the markets also went sideways for 16 years since the 2000 high. We might consolidate more for a few weeks but market is going much higher. 60% chance.

The bear scenario is the post Trump election stock market reaction was a blowoff and a real bear market is coming. 40% chance.

I don't the answer. The post Trump market run looks a little short compared to the 10 months of stock market action that preceded it. 99/00 had a nice 4 month blowoff, not 4 weeks.

More on the bulls case - The S&P (less frothy) and IWM (the leader to date) looks like they have finished 2 1-2s (that is how I drew the IWM chart above, S&P looks even cleaner) and what we have now is maybe our first 3rd wave in the major indices. The meat of the move you don't want to miss! Again, we had many derisking events in 2016 including the pre election in early November. I am using 1997/1998 and 1999/2000 as my market guides. If we break down from these examples, I will be out of everything. But we have not broken down yet. Here is what the IWM looked like in late 90s for your reference.

My short term answer for my own trading is I have cut my exposures some for first time in a year. I was 50-75% levered much of last year. I think in mid Dec (anticipatory, IWM was out of bollinger bands) or now (reactive, we've had a few IWM closes below the 20 day) are reasonable times to cut exposures, generally get off leverage, take some profits. I am still keeping a core unlevered market bet with trailing stops - set at 50 and 200 days. If market rips I'm there. If it breaks down, trailing stops will take me out. If we get a better short term set up, I have capital to deploy.

Examples of what I've done lately is selling half of my VIAV after completing a possible 5 after a possible O'Neil climax run (up 6 out of 7 days). But I am keeping half and listening to my own advice above. 200 day and 50 day are up trending. I should be using 200 day as a stop for a long term core position. My original thesis was Jan 2016 ended a 6 year downtrend in the stock.

Good luck to everyone in 2017 and Happy New Year! Hope the above helps. Please learn from my 2016 mistakes and improvements.

Subscribe to:

Comments (Atom)