I'm going to give you quick observations on my potential top ideas.

CS - Still waiting for final flush in second part of a leading diagonal. So far it looks perfect to me. Before this diagonal CS had 3 corrections down. There are never 4. That's why it has top idea potential if it sets up again. Love at 13 on a bad earnings reaction or europe headline.

GDX - has already taken out trendline of a double 3 correction. Took out 50 day. About to take out 200 day that will be another confirm of another new uptrend. I own this and component leader ABX.

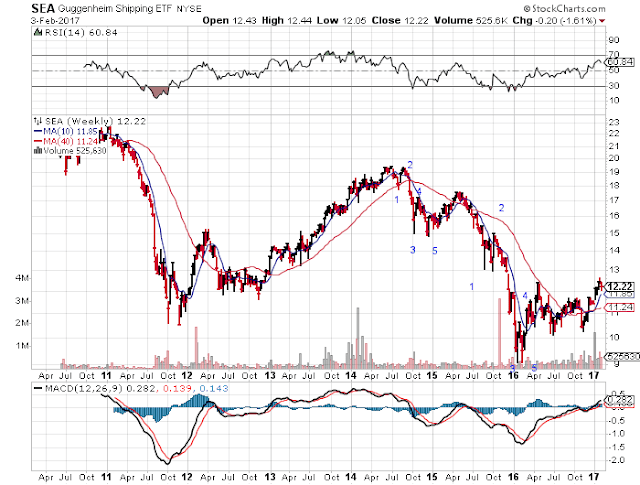

SEA - Coming into 50 day. Already has 50/200 day cross. After a second 5-3-5 down much like IWM in 2015/early 2016. Had a 9 month correction, now trying to uptrend.

CCJ - Uranium stocks had big run last 2 months and now consolidating big run. CCJ is the leader. About to complete a first ABC down. At 50 day. 200 day not far away. Those are good spot trade spots. Have a starter position in CCJ the last 2 days and early took a starter position in rare earths REMX. Looking at ETF URA.

No comments:

Post a Comment