Market Health

We got a day 4 follow through day this week. So far it hasn't failed. There were sentiment gauges that were showing investors were at similar levels of caution shown in 2008. There is a good chance this one will stick.

The Russell, the weakest on the way down, is now the leader off the bottom. It looks to me like it completed the final 5th wave in a zig zag discussed in previous reports. I like how the MACD is turning up. At the lows, the Russell was down 30%.

Leaders

Leadership is narrow.

LITE is still holding its pivot. I'm trying not to overthink it.

VIAV is still holding its pivot point and now its trendline breakout without a stop out. Again not trying to overthink it. I could see a handle starting some time next week. Could be a nice add if it forms properly.

Watchlist

There are other stocks like FB where I am trying to see if they right themselves after stop outs. Not a lot of setups I like right now. I am just focused on 3 favorite long trades - IWM, LITE, VIAV.

Sunday, February 21, 2016

Tuesday, February 16, 2016

Update - 2/16/16

Update - 2/16/16

I don't have much to add this week. We haven't had a proper follow through day yet but we are on the look out for one given the market made new lows in a 5. You never know when a 5 is going to end. But we were out of the weekly bollinger bands again for the indices and at key spots outlined in the past.

LITE and VIAV still look good and haven't stopped you out since last pivot and pocket pivot points.

FB has stopped people out yet again.

Hopefully I can add more thoughts in the weeks to come.

I don't have much to add this week. We haven't had a proper follow through day yet but we are on the look out for one given the market made new lows in a 5. You never know when a 5 is going to end. But we were out of the weekly bollinger bands again for the indices and at key spots outlined in the past.

LITE and VIAV still look good and haven't stopped you out since last pivot and pocket pivot points.

FB has stopped people out yet again.

Hopefully I can add more thoughts in the weeks to come.

Saturday, February 6, 2016

Leaders & Market Update - 2/6/16

This was a very interesting week!

Market Health

So far he have a follow through day that hasn't followed through. It hasn't completely failed yet either although it is trying. My best guess is the market still needs to make a "5" down to complete this correction/bear market. I show the Russell, but the S&P is similar in structure if not severity.

Lesson in Why Stops are Good and "Bad Things" Can Happen Below 50 Day

LNKD - LNKD had some pocket pivots 3 months ago before and after earnings. It looked like it was in a big macro double bottom base potentially. It even looked to me like QCOM 98/99 initially. But then LNKD diverged from historical precedent. It didn't form a base within a base. It got looser. If you played those pocket pivots, you got stopped out. It lived below the 50 day. It actually lived below all of its moving averages going into EPS. There was no reason to be there long and yesterday showed why. Bad earnings report. And they are closing one of their businesses which was supposed to be a growth driver - Lead Navigator (sales product). LNKD actually led the market, tech and beta stocks down yesterday.

Wait, Are There Individual Stocks That Are Building RS and Getting Healthy???!!!

We actually had one pocket pivot and one watch list stock put in pocket pivots and breakouts this week. Crazy right? Yesterday felt like a day where everything should be going down.

You always have to follow your stocks first and not impose your market view on them. Also, when you are this late in a correction, we do have names that start to break out and emerge. In 1Q 09, when the market made its final whoosh down, AMZN was already up over 80% and not budging. My best friend in trading brought that name to my attention at the time, and wow was he right on that one.

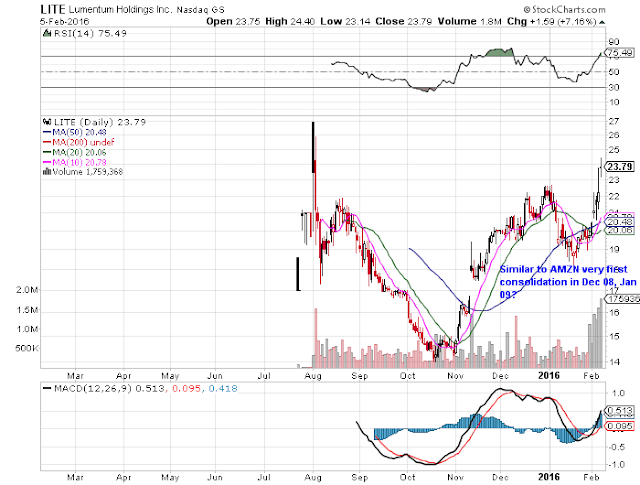

There are some similarities with LITE now. Listen, LITE is probably not going to become CSCO 89-99 or AMZN 09-16 or AAPL - one of the few core leader stocks that are foundational to the market and our economy. But it could become a very nice leader like an NXPI or SWKS. Or a TASR in 2003. It could have a very nice component, product cycle and still become a "big stock".

Here is the weekly chart of LITE. It broke out on earnings yesterday. Like AMZN 09, it has held early pivot points from a few months ago and now is making new highs. Nice tight weekly action in this last handle. If LITE stops a trade out from the new 22.90 pivot, so be it. But you have a new stock breaking out, when the market is still weak - don't overthink it, if you like it, make it stop you out from here.

LITE had "good" earnings on Thurs night. If you look at the headlines, it's not like LITE crushed its numbers. But they did beat. More importantly, they had great things to say about the coming 100G cycle. They already are 1Q into 100G cycle in their telecom business. Their comments were strong there. But they had "surprisingly" strong comments on their cloud/data center business with regard to the industry and their market share wins. In short, they feel like that business will start to grow again this Q and they are very optimistic about 100G cycle in the data center starting now and them being the biggest beneficiary. I would encourage you if you are in LITE to read the earnings transcript. You can skim it in 10 min; you can find it on Seeking Alpha.

VIAV - Put in a potential breakaway gap and first pocket pivot off earnings. 120% earnings growth. Great new CEO from International Rectifier, which was a big stock under his watch and sold (I think to Infineon). We all like CEOs who manage companies well and sell them for top dollar, right?

VIAV is an example of why you put things on your watch list "early." You can play the pocket pivot this week if you want too. Watch its EPS report. You can be on the lookout for a handle here.

FB - came in hard to the breakout on volume. Billy O says 50% of healthy breakouts do this. If you love FB, make it stop you out, 8% from this pivot.

Market Health

So far he have a follow through day that hasn't followed through. It hasn't completely failed yet either although it is trying. My best guess is the market still needs to make a "5" down to complete this correction/bear market. I show the Russell, but the S&P is similar in structure if not severity.

Lesson in Why Stops are Good and "Bad Things" Can Happen Below 50 Day

LNKD - LNKD had some pocket pivots 3 months ago before and after earnings. It looked like it was in a big macro double bottom base potentially. It even looked to me like QCOM 98/99 initially. But then LNKD diverged from historical precedent. It didn't form a base within a base. It got looser. If you played those pocket pivots, you got stopped out. It lived below the 50 day. It actually lived below all of its moving averages going into EPS. There was no reason to be there long and yesterday showed why. Bad earnings report. And they are closing one of their businesses which was supposed to be a growth driver - Lead Navigator (sales product). LNKD actually led the market, tech and beta stocks down yesterday.

Wait, Are There Individual Stocks That Are Building RS and Getting Healthy???!!!

We actually had one pocket pivot and one watch list stock put in pocket pivots and breakouts this week. Crazy right? Yesterday felt like a day where everything should be going down.

You always have to follow your stocks first and not impose your market view on them. Also, when you are this late in a correction, we do have names that start to break out and emerge. In 1Q 09, when the market made its final whoosh down, AMZN was already up over 80% and not budging. My best friend in trading brought that name to my attention at the time, and wow was he right on that one.

There are some similarities with LITE now. Listen, LITE is probably not going to become CSCO 89-99 or AMZN 09-16 or AAPL - one of the few core leader stocks that are foundational to the market and our economy. But it could become a very nice leader like an NXPI or SWKS. Or a TASR in 2003. It could have a very nice component, product cycle and still become a "big stock".

Here is the weekly chart of LITE. It broke out on earnings yesterday. Like AMZN 09, it has held early pivot points from a few months ago and now is making new highs. Nice tight weekly action in this last handle. If LITE stops a trade out from the new 22.90 pivot, so be it. But you have a new stock breaking out, when the market is still weak - don't overthink it, if you like it, make it stop you out from here.

LITE had "good" earnings on Thurs night. If you look at the headlines, it's not like LITE crushed its numbers. But they did beat. More importantly, they had great things to say about the coming 100G cycle. They already are 1Q into 100G cycle in their telecom business. Their comments were strong there. But they had "surprisingly" strong comments on their cloud/data center business with regard to the industry and their market share wins. In short, they feel like that business will start to grow again this Q and they are very optimistic about 100G cycle in the data center starting now and them being the biggest beneficiary. I would encourage you if you are in LITE to read the earnings transcript. You can skim it in 10 min; you can find it on Seeking Alpha.

VIAV - Put in a potential breakaway gap and first pocket pivot off earnings. 120% earnings growth. Great new CEO from International Rectifier, which was a big stock under his watch and sold (I think to Infineon). We all like CEOs who manage companies well and sell them for top dollar, right?

VIAV is an example of why you put things on your watch list "early." You can play the pocket pivot this week if you want too. Watch its EPS report. You can be on the lookout for a handle here.

FB - came in hard to the breakout on volume. Billy O says 50% of healthy breakouts do this. If you love FB, make it stop you out, 8% from this pivot.

Saturday, January 30, 2016

Market and Leaders Update - 1/30/16

Market Update

We had a follow through day yesterday. We had a lot of negativity at recent market lows. And we were at key levels for the indices. We now have a leader or 2 that has broken out. From that perspective, this is follow through that could stick. If one is a long term allocator to the market, I think it is an easy decision to allocate to the market here. Either cheating ahead of the follow through day (marked with an F below), or allocating yesterday. I'm not sure I'd have all of my chips in there, but I think one should have put a chunk of long term assets back in the market late this week.

Short term traders also had the basis for a market trade too and now have a stop. If you are a short term trader, you should be using the low of yesterday in the market as your stop especially if we get meaningful distribution quickly. If you like to ride a trend and a winner, you should see if this follow through day sticks. Make it stop you out. For all we know, the market could be starting a 30-50% run. Risk 2% to make that is not bad.

Not all follow through days stick. If this one doesn't, it will be because the market needs to carve out one more low. On the weekly chart, The Russell could be in a zig zag. 5 waves down, 3 waves up, 5 waves down where we still need the final 5th wave. If this follow through day doesn't stick, it's also because we have a leader or 2 not 50.

Longer term, I do love that the Russell outperformed the S&P off this low!

I think through the market for long term allocation decisions. And to get a general feeling if I have the wind at my back on individual stocks. That's it. I always put individual stock action first when looking at a specific stock.

Leaders Update

As always, I let individual stock action guide me above all else. Going into this week, LITE was my only watch list name that had held an earlier pocket pivot and has constructive action.

LITE

Put in a 4th tight Week! Despite all of the above, I suspect LITE might need to carve out a lower low in this base with in a base. I would not be surpised by 6-7 week cup or double bottom within the larger cup.

FB

Broke out this week on earnings. FB has been a choppy trader for the last 2 years, stopping O'Neil rule followers out of many entries. It happens. It's possible this one can stick and start to trend.

Watch list Update

VIAV - I had this on a watch list due to EPS acceleration and a new product cycle. It also had the classic big stock initial entry setup of cheap valuation, poor sentiment and potential powerful catalysts coming, But there has been no ONeil or pocket pivot set up yet. But I have drawn the Elliott Wave case on how this has been in its final wave down. Since early 2011 (after its incredible 2 year run), this has put in a double 3. A zig zag (5-3-5) and a flat (3-3-5) which made a new low. I have seen many big stocks emerge from this formation. This one will need to put in a pocket pivot first, build some RS, and build a real base down the road.

I do these types of exercise to stalk a long term trade. Pay attention for big product cycles, what could work down the road. It's very hard to buy things down the road if you haven't done the prep ahead of time.

LNKD

This had pocket pivots and breakaway gaps in late 15 that eventually failed. It does have earnings acceleration and fundamental leadership qualities. So it stays on the watch list. Right now this could be a base within a base. Or could be plunging to new lows. We have earnings this week. My nose says it will be base within a base. But that's it. There is no Neil or pocket pivot setup currently.

We had a follow through day yesterday. We had a lot of negativity at recent market lows. And we were at key levels for the indices. We now have a leader or 2 that has broken out. From that perspective, this is follow through that could stick. If one is a long term allocator to the market, I think it is an easy decision to allocate to the market here. Either cheating ahead of the follow through day (marked with an F below), or allocating yesterday. I'm not sure I'd have all of my chips in there, but I think one should have put a chunk of long term assets back in the market late this week.

Short term traders also had the basis for a market trade too and now have a stop. If you are a short term trader, you should be using the low of yesterday in the market as your stop especially if we get meaningful distribution quickly. If you like to ride a trend and a winner, you should see if this follow through day sticks. Make it stop you out. For all we know, the market could be starting a 30-50% run. Risk 2% to make that is not bad.

Not all follow through days stick. If this one doesn't, it will be because the market needs to carve out one more low. On the weekly chart, The Russell could be in a zig zag. 5 waves down, 3 waves up, 5 waves down where we still need the final 5th wave. If this follow through day doesn't stick, it's also because we have a leader or 2 not 50.

Longer term, I do love that the Russell outperformed the S&P off this low!

I think through the market for long term allocation decisions. And to get a general feeling if I have the wind at my back on individual stocks. That's it. I always put individual stock action first when looking at a specific stock.

Leaders Update

As always, I let individual stock action guide me above all else. Going into this week, LITE was my only watch list name that had held an earlier pocket pivot and has constructive action.

LITE

Put in a 4th tight Week! Despite all of the above, I suspect LITE might need to carve out a lower low in this base with in a base. I would not be surpised by 6-7 week cup or double bottom within the larger cup.

FB

Broke out this week on earnings. FB has been a choppy trader for the last 2 years, stopping O'Neil rule followers out of many entries. It happens. It's possible this one can stick and start to trend.

Watch list Update

VIAV - I had this on a watch list due to EPS acceleration and a new product cycle. It also had the classic big stock initial entry setup of cheap valuation, poor sentiment and potential powerful catalysts coming, But there has been no ONeil or pocket pivot set up yet. But I have drawn the Elliott Wave case on how this has been in its final wave down. Since early 2011 (after its incredible 2 year run), this has put in a double 3. A zig zag (5-3-5) and a flat (3-3-5) which made a new low. I have seen many big stocks emerge from this formation. This one will need to put in a pocket pivot first, build some RS, and build a real base down the road.

I do these types of exercise to stalk a long term trade. Pay attention for big product cycles, what could work down the road. It's very hard to buy things down the road if you haven't done the prep ahead of time.

LNKD

This had pocket pivots and breakaway gaps in late 15 that eventually failed. It does have earnings acceleration and fundamental leadership qualities. So it stays on the watch list. Right now this could be a base within a base. Or could be plunging to new lows. We have earnings this week. My nose says it will be base within a base. But that's it. There is no Neil or pocket pivot setup currently.

Monday, January 25, 2016

Market and Leaders Update - 1/24/16

Market Health

Still no follow through day. The Market Indices did put in weekly hammer at key levels of support. The August lows for the S&P and one of the support lines I drew for the Russell. I am thinking the Russell turning is going to be a key for the overall market.

My best guess is we rally this week and then we make one more low. For you Elliot Wavers, I think the Russell if carving out a zig-zag - a 5-3-5. We have have now had 4 of the final 5.

Watch list update

I have removed one name from the watch list, N. I didn't like that is made a lower low from its spring 2014 low. My technical opinion was it was consolidating its gains from that low and getting ready to blast higher. A lower low to me makes this look like a broken former leader for now.

My other 3 names have positive developments. LITE is by far the most positive for the long term.

LITE - Put in its third week tight. My best guess is this will pop and then make a lower low in this handle controlled fashion. So far love the tightness and RS.

LNKD - They did reach for this on Friday unlike N. This put in a nice weekly candle. I have been trying to figure out if this is destined to make a new low vs early 2015. Or whether this a proper low in a smaller base. No pocket pivots. This sits +30 point below 50 50 day and pivot point, with earnings in a week and half. This does have accelerating bottom like EPS and so far little fundamental concerns compared to a TWTR.

VIAV - This looks the final leg down. Put in week of accumulation.

Market Health

Still no follow through day. The Market Indices did put in weekly hammer at key levels of support. The August lows for the S&P and one of the support lines I drew for the Russell. I am thinking the Russell turning is going to be a key for the overall market.

My best guess is we rally this week and then we make one more low. For you Elliot Wavers, I think the Russell if carving out a zig-zag - a 5-3-5. We have have now had 4 of the final 5.

Watch list update

I have removed one name from the watch list, N. I didn't like that is made a lower low from its spring 2014 low. My technical opinion was it was consolidating its gains from that low and getting ready to blast higher. A lower low to me makes this look like a broken former leader for now.

My other 3 names have positive developments. LITE is by far the most positive for the long term.

LITE - Put in its third week tight. My best guess is this will pop and then make a lower low in this handle controlled fashion. So far love the tightness and RS.

LNKD - They did reach for this on Friday unlike N. This put in a nice weekly candle. I have been trying to figure out if this is destined to make a new low vs early 2015. Or whether this a proper low in a smaller base. No pocket pivots. This sits +30 point below 50 50 day and pivot point, with earnings in a week and half. This does have accelerating bottom like EPS and so far little fundamental concerns compared to a TWTR.

VIAV - This looks the final leg down. Put in week of accumulation.

Tuesday, January 19, 2016

Market Update

The market has spoken, and we have had a "more severe correction." The odds toward a correction where we have a 20% correction (bear market) in the major indices has increased as we made a new low in the S&P 500.

We still haven't had a follow through day, but we should still be on the lookout for one despite the above. The Russell has led us down, is in bear market territory, and I have drawn a few lines where we might eventually get support. We are very oversold, I circled a few pertinent indicators. But Friday put/calls, oversold oscillators got to pretty severe levels. I thought we might bounce and make one more low.

Watch list update -

LITE - Still holding its pocket pivot and it put in a tight week in a handle. Encouraging.

N, LNKD - same camp. No pocket pivots in the bases that have held. If they are forming real bases, this would have to be the lows of their bases. No much more to say. They stay on my watch list for pocket pivots down the road.

VIAV - Similar to N and LNKD. The one thing I would add though is for you Elliott wavers: VIAV is definitely in its final corrective wave. There is no such thing as a quadruple 3. I will try and explain in a subsequent post. But here is the weekly. At key levels.

The market has spoken, and we have had a "more severe correction." The odds toward a correction where we have a 20% correction (bear market) in the major indices has increased as we made a new low in the S&P 500.

We still haven't had a follow through day, but we should still be on the lookout for one despite the above. The Russell has led us down, is in bear market territory, and I have drawn a few lines where we might eventually get support. We are very oversold, I circled a few pertinent indicators. But Friday put/calls, oversold oscillators got to pretty severe levels. I thought we might bounce and make one more low.

Watch list update -

LITE - Still holding its pocket pivot and it put in a tight week in a handle. Encouraging.

N, LNKD - same camp. No pocket pivots in the bases that have held. If they are forming real bases, this would have to be the lows of their bases. No much more to say. They stay on my watch list for pocket pivots down the road.

VIAV - Similar to N and LNKD. The one thing I would add though is for you Elliott wavers: VIAV is definitely in its final corrective wave. There is no such thing as a quadruple 3. I will try and explain in a subsequent post. But here is the weekly. At key levels.

Sunday, January 10, 2016

Market and Leaders Update - 1/10/16

Market Update - 1/10/16

The market continued its correction this week. We have yet to have a follow through day. With the FFTY mutual fund down almost 18% since inception and a lot of false market health signals, I think a lot of people are getting ready to throw in the towel on IBD market signals. Which probably means their methodology will start to work again and we will get a trending market. It has been a great methodology that has worked well over 115 years. Nothing works 100% all the time.

My thesis continues to be we are in a mild correction and not a bear market. Intermediate corrections can still feel severe during the capitulation stage. After all, they are corrections. And the best bases, handles, corrections all have capitulations at their bottoms that rinse out the sellers. The S&P hasn't made a lower low yet versus the August lows. This still could be an intermediate correction and not the next leg of bear market.

Although our larger cap indices are still far away from bear market territory, the Russell and small caps are right there. They are also at a key level, the October 2014 low. The RSI is oversold too. Even in bear markets like 08, we are around a spot where we will get a bounce.

But the main point is during corrections, we need to have a watch list of great merchandise we would want to buy if and when the market turns. What has leadership potential? Are you going to sit their and doubt a rally for 3-4 weeks if it comes? Do you have some names that wouldn't surprise you if they ripped instantly if and when the market turned. Where would you buy them? What price levels would give you conviction that your leader is moving onward and upward and market health has returned? Because I can tell you, it is pretty negative right now. China can't open their markets for more than 45 minutes. We have had many things to worry about over the last 2 years, emerging markets, commodities, interest rates going up. The market is up over 100% since 08 and people are waiting for the next bear market and opportunity. "I'm going to wait for a bear market to get in." I know many great money managers that had their second flat year in a row in 2015. I know others that were down.

We do need a follow through day though. We still haven't had one.

Watch List Update

LPTH - Added to watch list last week. I missed the first entry. Given this doubled in 8 weeks and has incredible sales growth, this has high tight flag potential. Last week was week one. 20% drop, but nice tight weekly close. Let's watch this like a hawk the next 2 weeks.

LITE - We put in week 1 of a real handle. This is the first real handle in the base, this is what we've been looking for. If you bought the pocket pivot on earnings day (early November), you are still safe and have a nice entry. The bottom of the cup (like LNKD) has a lower low (that's good). Next entry is now the top of this handle (22.64).

LNKD - has yet to put in a pocket pivot in this current handle/base. And is now building more a V type base within a base or a handle. But that's ok. Some of the best bases, like FSLR 07 and DELL 96 can be sharp and V like. Still on my watch list, waiting for a first pocket pivot (in this handle) which would be way up at 237-238. Lots of tight weekly closes, last week wasn't one of them. If you bought the gap up day on earnings day, interpreting that as a breakaway gap within the larger base, you have now been stopped out. It happens, part of the game.

VIAV - has not put in a pocket pivot yet or trendline break yet. What i thought might a double bottom is turning into a deeper cup. No entries yet. Entries are 6.16 (trendline) or 6.56 (top of cup). The cup still has tight weeklies and is shallow. Still has potential.

N - hasn't had a pocket pivot since early December (which failed). Still a great long term base. Entries are 50 day (84.10 pocket pivot) and 88 (trendline).

Stalking Trades Mindset

Just because many leaders haven't broken out yet, don't give up on names or watch list building. The best investors and traders identify potential A+ trades and stalk them.

The market continued its correction this week. We have yet to have a follow through day. With the FFTY mutual fund down almost 18% since inception and a lot of false market health signals, I think a lot of people are getting ready to throw in the towel on IBD market signals. Which probably means their methodology will start to work again and we will get a trending market. It has been a great methodology that has worked well over 115 years. Nothing works 100% all the time.

My thesis continues to be we are in a mild correction and not a bear market. Intermediate corrections can still feel severe during the capitulation stage. After all, they are corrections. And the best bases, handles, corrections all have capitulations at their bottoms that rinse out the sellers. The S&P hasn't made a lower low yet versus the August lows. This still could be an intermediate correction and not the next leg of bear market.

Although our larger cap indices are still far away from bear market territory, the Russell and small caps are right there. They are also at a key level, the October 2014 low. The RSI is oversold too. Even in bear markets like 08, we are around a spot where we will get a bounce.

But the main point is during corrections, we need to have a watch list of great merchandise we would want to buy if and when the market turns. What has leadership potential? Are you going to sit their and doubt a rally for 3-4 weeks if it comes? Do you have some names that wouldn't surprise you if they ripped instantly if and when the market turned. Where would you buy them? What price levels would give you conviction that your leader is moving onward and upward and market health has returned? Because I can tell you, it is pretty negative right now. China can't open their markets for more than 45 minutes. We have had many things to worry about over the last 2 years, emerging markets, commodities, interest rates going up. The market is up over 100% since 08 and people are waiting for the next bear market and opportunity. "I'm going to wait for a bear market to get in." I know many great money managers that had their second flat year in a row in 2015. I know others that were down.

We do need a follow through day though. We still haven't had one.

Watch List Update

LPTH - Added to watch list last week. I missed the first entry. Given this doubled in 8 weeks and has incredible sales growth, this has high tight flag potential. Last week was week one. 20% drop, but nice tight weekly close. Let's watch this like a hawk the next 2 weeks.

LITE - We put in week 1 of a real handle. This is the first real handle in the base, this is what we've been looking for. If you bought the pocket pivot on earnings day (early November), you are still safe and have a nice entry. The bottom of the cup (like LNKD) has a lower low (that's good). Next entry is now the top of this handle (22.64).

LNKD - has yet to put in a pocket pivot in this current handle/base. And is now building more a V type base within a base or a handle. But that's ok. Some of the best bases, like FSLR 07 and DELL 96 can be sharp and V like. Still on my watch list, waiting for a first pocket pivot (in this handle) which would be way up at 237-238. Lots of tight weekly closes, last week wasn't one of them. If you bought the gap up day on earnings day, interpreting that as a breakaway gap within the larger base, you have now been stopped out. It happens, part of the game.

VIAV - has not put in a pocket pivot yet or trendline break yet. What i thought might a double bottom is turning into a deeper cup. No entries yet. Entries are 6.16 (trendline) or 6.56 (top of cup). The cup still has tight weeklies and is shallow. Still has potential.

N - hasn't had a pocket pivot since early December (which failed). Still a great long term base. Entries are 50 day (84.10 pocket pivot) and 88 (trendline).

Stalking Trades Mindset

Just because many leaders haven't broken out yet, don't give up on names or watch list building. The best investors and traders identify potential A+ trades and stalk them.

Subscribe to:

Posts (Atom)