Here are updates on my recent trade ideas

CCJ - Came into 200 day and had nice bounce! I added down around the 200 day. Like how name shrugged off mediocre EPS. It regained 50 day. I'd like to see the action tighten up now and generally start to ride that 50 day up.

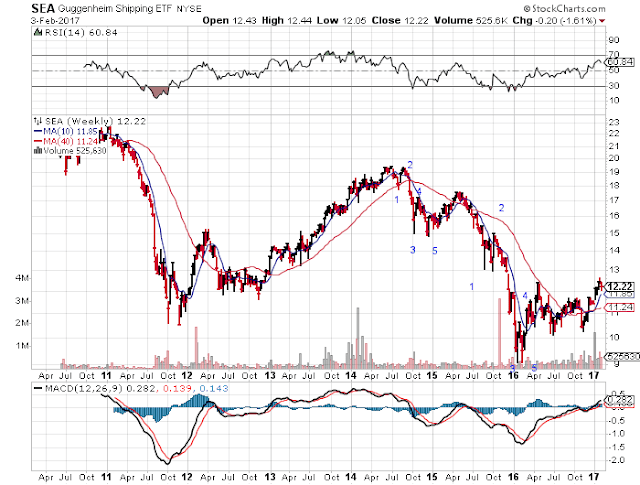

SEA - Could be forming first proper handle and had a "continuation" pocket pivot on Friday. I added on the day it came into 50 day. Handle might need more work.

ABX/GDX - GDX took out 200 day this week. A good sign. ABX, shown here, is the strongest name in the group. If they form handles properly, I will add. Have nice sized core positions from weeks past. Most of the places where I see strength are inflationary! I am noticing a theme.

VIAV - Short term blow off top? Sold half.

CS - working on that last shakeout. No adds yet.

TBT - I would LOVE this down by the 200 day.

Z - never broke out. broken for now. That's why I had small cheater position on and nothing too aggressive. I sold the day of EPS when it gapped below 50 and 200 days. Wait for proper entry if it sets up again.

Sunday, February 12, 2017

Sunday, February 5, 2017

Update - 2/5/17

The indices are still in no man's land in the short term. Long term they still look solid. I sold another 1/4 of my SPY exposure from 2016...basically to finance single stock positions, some highlighted below.

I'm going to give you quick observations on my potential top ideas.

CS - Still waiting for final flush in second part of a leading diagonal. So far it looks perfect to me. Before this diagonal CS had 3 corrections down. There are never 4. That's why it has top idea potential if it sets up again. Love at 13 on a bad earnings reaction or europe headline.

GDX - has already taken out trendline of a double 3 correction. Took out 50 day. About to take out 200 day that will be another confirm of another new uptrend. I own this and component leader ABX.

SEA - Coming into 50 day. Already has 50/200 day cross. After a second 5-3-5 down much like IWM in 2015/early 2016. Had a 9 month correction, now trying to uptrend.

CCJ - Uranium stocks had big run last 2 months and now consolidating big run. CCJ is the leader. About to complete a first ABC down. At 50 day. 200 day not far away. Those are good spot trade spots. Have a starter position in CCJ the last 2 days and early took a starter position in rare earths REMX. Looking at ETF URA.

I'm going to give you quick observations on my potential top ideas.

CS - Still waiting for final flush in second part of a leading diagonal. So far it looks perfect to me. Before this diagonal CS had 3 corrections down. There are never 4. That's why it has top idea potential if it sets up again. Love at 13 on a bad earnings reaction or europe headline.

GDX - has already taken out trendline of a double 3 correction. Took out 50 day. About to take out 200 day that will be another confirm of another new uptrend. I own this and component leader ABX.

SEA - Coming into 50 day. Already has 50/200 day cross. After a second 5-3-5 down much like IWM in 2015/early 2016. Had a 9 month correction, now trying to uptrend.

CCJ - Uranium stocks had big run last 2 months and now consolidating big run. CCJ is the leader. About to complete a first ABC down. At 50 day. 200 day not far away. Those are good spot trade spots. Have a starter position in CCJ the last 2 days and early took a starter position in rare earths REMX. Looking at ETF URA.

Subscribe to:

Comments (Atom)