Market Health

We got a day 4 follow through day this week. So far it hasn't failed. There were sentiment gauges that were showing investors were at similar levels of caution shown in 2008. There is a good chance this one will stick.

The Russell, the weakest on the way down, is now the leader off the bottom. It looks to me like it completed the final 5th wave in a zig zag discussed in previous reports. I like how the MACD is turning up. At the lows, the Russell was down 30%.

Leaders

Leadership is narrow.

LITE is still holding its pivot. I'm trying not to overthink it.

VIAV is still holding its pivot point and now its trendline breakout without a stop out. Again not trying to overthink it. I could see a handle starting some time next week. Could be a nice add if it forms properly.

Watchlist

There are other stocks like FB where I am trying to see if they right themselves after stop outs. Not a lot of setups I like right now. I am just focused on 3 favorite long trades - IWM, LITE, VIAV.

Sunday, February 21, 2016

Tuesday, February 16, 2016

Update - 2/16/16

Update - 2/16/16

I don't have much to add this week. We haven't had a proper follow through day yet but we are on the look out for one given the market made new lows in a 5. You never know when a 5 is going to end. But we were out of the weekly bollinger bands again for the indices and at key spots outlined in the past.

LITE and VIAV still look good and haven't stopped you out since last pivot and pocket pivot points.

FB has stopped people out yet again.

Hopefully I can add more thoughts in the weeks to come.

I don't have much to add this week. We haven't had a proper follow through day yet but we are on the look out for one given the market made new lows in a 5. You never know when a 5 is going to end. But we were out of the weekly bollinger bands again for the indices and at key spots outlined in the past.

LITE and VIAV still look good and haven't stopped you out since last pivot and pocket pivot points.

FB has stopped people out yet again.

Hopefully I can add more thoughts in the weeks to come.

Saturday, February 6, 2016

Leaders & Market Update - 2/6/16

This was a very interesting week!

Market Health

So far he have a follow through day that hasn't followed through. It hasn't completely failed yet either although it is trying. My best guess is the market still needs to make a "5" down to complete this correction/bear market. I show the Russell, but the S&P is similar in structure if not severity.

Lesson in Why Stops are Good and "Bad Things" Can Happen Below 50 Day

LNKD - LNKD had some pocket pivots 3 months ago before and after earnings. It looked like it was in a big macro double bottom base potentially. It even looked to me like QCOM 98/99 initially. But then LNKD diverged from historical precedent. It didn't form a base within a base. It got looser. If you played those pocket pivots, you got stopped out. It lived below the 50 day. It actually lived below all of its moving averages going into EPS. There was no reason to be there long and yesterday showed why. Bad earnings report. And they are closing one of their businesses which was supposed to be a growth driver - Lead Navigator (sales product). LNKD actually led the market, tech and beta stocks down yesterday.

Wait, Are There Individual Stocks That Are Building RS and Getting Healthy???!!!

We actually had one pocket pivot and one watch list stock put in pocket pivots and breakouts this week. Crazy right? Yesterday felt like a day where everything should be going down.

You always have to follow your stocks first and not impose your market view on them. Also, when you are this late in a correction, we do have names that start to break out and emerge. In 1Q 09, when the market made its final whoosh down, AMZN was already up over 80% and not budging. My best friend in trading brought that name to my attention at the time, and wow was he right on that one.

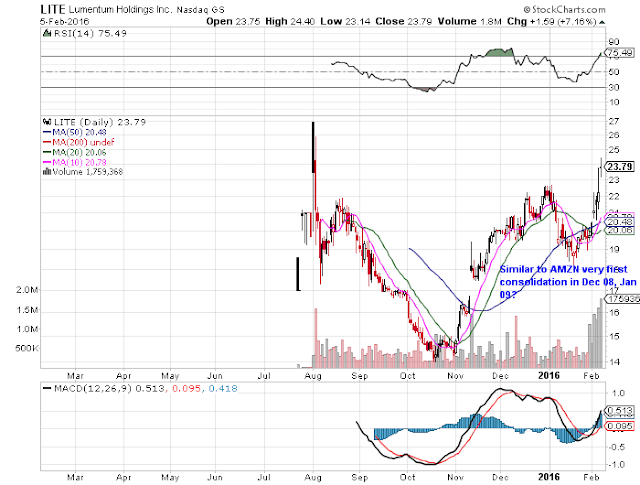

There are some similarities with LITE now. Listen, LITE is probably not going to become CSCO 89-99 or AMZN 09-16 or AAPL - one of the few core leader stocks that are foundational to the market and our economy. But it could become a very nice leader like an NXPI or SWKS. Or a TASR in 2003. It could have a very nice component, product cycle and still become a "big stock".

Here is the weekly chart of LITE. It broke out on earnings yesterday. Like AMZN 09, it has held early pivot points from a few months ago and now is making new highs. Nice tight weekly action in this last handle. If LITE stops a trade out from the new 22.90 pivot, so be it. But you have a new stock breaking out, when the market is still weak - don't overthink it, if you like it, make it stop you out from here.

LITE had "good" earnings on Thurs night. If you look at the headlines, it's not like LITE crushed its numbers. But they did beat. More importantly, they had great things to say about the coming 100G cycle. They already are 1Q into 100G cycle in their telecom business. Their comments were strong there. But they had "surprisingly" strong comments on their cloud/data center business with regard to the industry and their market share wins. In short, they feel like that business will start to grow again this Q and they are very optimistic about 100G cycle in the data center starting now and them being the biggest beneficiary. I would encourage you if you are in LITE to read the earnings transcript. You can skim it in 10 min; you can find it on Seeking Alpha.

VIAV - Put in a potential breakaway gap and first pocket pivot off earnings. 120% earnings growth. Great new CEO from International Rectifier, which was a big stock under his watch and sold (I think to Infineon). We all like CEOs who manage companies well and sell them for top dollar, right?

VIAV is an example of why you put things on your watch list "early." You can play the pocket pivot this week if you want too. Watch its EPS report. You can be on the lookout for a handle here.

FB - came in hard to the breakout on volume. Billy O says 50% of healthy breakouts do this. If you love FB, make it stop you out, 8% from this pivot.

Market Health

So far he have a follow through day that hasn't followed through. It hasn't completely failed yet either although it is trying. My best guess is the market still needs to make a "5" down to complete this correction/bear market. I show the Russell, but the S&P is similar in structure if not severity.

Lesson in Why Stops are Good and "Bad Things" Can Happen Below 50 Day

LNKD - LNKD had some pocket pivots 3 months ago before and after earnings. It looked like it was in a big macro double bottom base potentially. It even looked to me like QCOM 98/99 initially. But then LNKD diverged from historical precedent. It didn't form a base within a base. It got looser. If you played those pocket pivots, you got stopped out. It lived below the 50 day. It actually lived below all of its moving averages going into EPS. There was no reason to be there long and yesterday showed why. Bad earnings report. And they are closing one of their businesses which was supposed to be a growth driver - Lead Navigator (sales product). LNKD actually led the market, tech and beta stocks down yesterday.

Wait, Are There Individual Stocks That Are Building RS and Getting Healthy???!!!

We actually had one pocket pivot and one watch list stock put in pocket pivots and breakouts this week. Crazy right? Yesterday felt like a day where everything should be going down.

You always have to follow your stocks first and not impose your market view on them. Also, when you are this late in a correction, we do have names that start to break out and emerge. In 1Q 09, when the market made its final whoosh down, AMZN was already up over 80% and not budging. My best friend in trading brought that name to my attention at the time, and wow was he right on that one.

There are some similarities with LITE now. Listen, LITE is probably not going to become CSCO 89-99 or AMZN 09-16 or AAPL - one of the few core leader stocks that are foundational to the market and our economy. But it could become a very nice leader like an NXPI or SWKS. Or a TASR in 2003. It could have a very nice component, product cycle and still become a "big stock".

Here is the weekly chart of LITE. It broke out on earnings yesterday. Like AMZN 09, it has held early pivot points from a few months ago and now is making new highs. Nice tight weekly action in this last handle. If LITE stops a trade out from the new 22.90 pivot, so be it. But you have a new stock breaking out, when the market is still weak - don't overthink it, if you like it, make it stop you out from here.

LITE had "good" earnings on Thurs night. If you look at the headlines, it's not like LITE crushed its numbers. But they did beat. More importantly, they had great things to say about the coming 100G cycle. They already are 1Q into 100G cycle in their telecom business. Their comments were strong there. But they had "surprisingly" strong comments on their cloud/data center business with regard to the industry and their market share wins. In short, they feel like that business will start to grow again this Q and they are very optimistic about 100G cycle in the data center starting now and them being the biggest beneficiary. I would encourage you if you are in LITE to read the earnings transcript. You can skim it in 10 min; you can find it on Seeking Alpha.

VIAV - Put in a potential breakaway gap and first pocket pivot off earnings. 120% earnings growth. Great new CEO from International Rectifier, which was a big stock under his watch and sold (I think to Infineon). We all like CEOs who manage companies well and sell them for top dollar, right?

VIAV is an example of why you put things on your watch list "early." You can play the pocket pivot this week if you want too. Watch its EPS report. You can be on the lookout for a handle here.

FB - came in hard to the breakout on volume. Billy O says 50% of healthy breakouts do this. If you love FB, make it stop you out, 8% from this pivot.

Subscribe to:

Comments (Atom)